Irs payroll withholding calculator

Be sure that your employee has given you a completed. Find 10 Best Payroll Services Systems 2022.

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Compare the Best Now.

. Lets call this the refund based adjust amount. Your employees W-4 forms Each employees gross pay for the pay period The IRS income tax. All Services Backed by Tax Guarantee.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Are a two-income family or someone with multiple jobs Work a seasonal job or only work part. Subtract 12900 for Married otherwise.

Carefully read all information and click the blue Withholding Calculator button. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Then look at your last paychecks tax withholding amount eg.

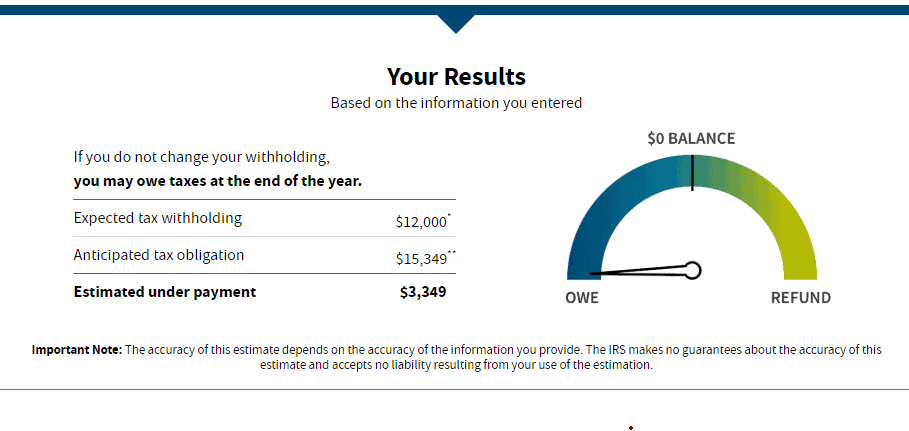

The Withholding Calculator is a tool on IRSgov designed to help employees determine how to have the right amount of tax withheld from their paychecks. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Contact us today for a free consultation. The maximum an employee will pay in 2022 is 911400. IRS tax forms.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Payroll HR Benefits Accounting Advisory and more thereby eliminating the costs of paying multiple salaries and vendors. Complete a new Form W-4 Employees Withholding Allowance.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Ad The New Year is the Best Time to Switch to a New Payroll Provider. 250 and subtract the refund adjust amount from that.

Feeling good about your numbers. 250 minus 200 50. For example if an employee earns 1500 per week the individuals annual.

Use our Tax Withholding Estimator You should check your withholding if you. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. 360 Payroll Solutions serves small to medium-sized businesses in all 50 states.

The calculator helps you determine the. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Withholding Calculator asks taxpayers to estimate their 2018 income and other items that affect their taxes including the number of children claimed for the Child Tax.

Use the buttons at the bottom of. The calculator includes options for estimating Federal Social Security and Medicare Tax. Smart Planning for Financial.

Affordable Easy-to-Use Try Now. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2022. Go to the main Withholding Calculator page on IRSgov.

Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. It is a more accurate alternative to. To change your tax withholding use the results from the Withholding Estimator to determine if you should.

To calculate withholding tax youll need the following information. To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Take these steps to fill out your new W-4. 2022 Federal income tax withholding calculation. We seek to meet every back office need.

Ad Payroll So Easy You Can Set It Up Run It Yourself.

Console Irs Tax Calculator In Java Code Review Stack Exchange

Tax Withholding Estimator New Free 2019 2020 Irs Youtube

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Irs Launches New Tax Withholding Estimator

/IRS-4e41b1914e44408786b4537951deabcd.jpg)

What Is Tax Liability

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Withholding Estimator Shortcomings Virginia Cpa

What To Do If You Receive A Missing Tax Return Notice From The Irs

Irs Improves Online Tax Withholding Calculator

How To Calculate Payroll Taxes For Employees Startuplift

Irs Creates Paycheck Checkup Flyer News Illinois State

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

The Irs Made Me File A Paper Return Then Lost It

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Wrapbook